The water industry has seen gradual growth in the adoption of Advanced Metering Infrastructure (AMI) and related data analytics solutions over the past decade, but that rate of growth has been modest at best. This is somewhat surprising given the well documented benefits of AMI including lower costs, revenue recovery, improved operational efficiency, and increased customer satisfaction. If AMI provides so many advantages to water suppliers and their customers, why isn’t every utility in the country clamoring to implement smart metering? What barriers are discouraging more rapid technology adoption and how, as an industry, do we support each other to overcome these challenges to unlock the power of water data?

To better understand the dynamics of these growth trends, it’s interesting to consider the perspectives of modern thought leaders on the subjects of behavioral psychology and technology adoption as it relates to the digitization of the water industry. These technologists are not experts in water, but many of the underlying tenets of their work can be easily applied to the current state of technology evolution in the water industry.

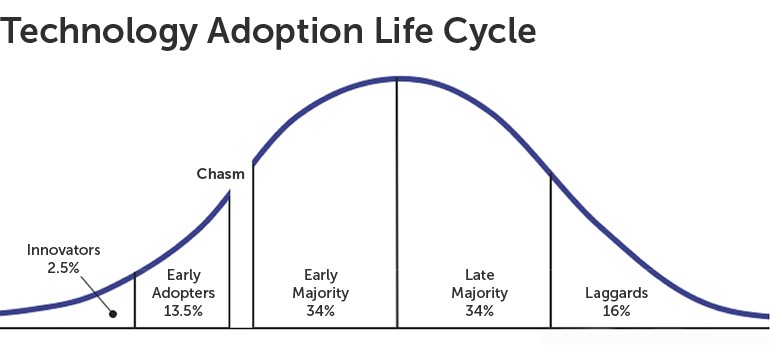

Geoffrey Moore, the organizational theorist and venture capitalist, famously described the evolution of technology adoption in his 1991 book, Crossing the Chasm. Moore argues that there is a gap, or chasm, between early adopters of new technologies (visionaries) and the early majority (pragmatists). These different customer groups have varying emotional and psycho-social needs. Their respective perceptions of cultural status in terms of technology usage may vary dramatically. Part of the difference between these groups is their relative tolerance for risk, but it is also due to how each group associates with others like them.

Marketing guru Seth Godin often says, “People like us do things like this.” What he means by this is that we associate certain cultural behavior with social status and identity. We feel a sense of belonging when we adhere to cultural norms in general, but more importantly, when we engage in behaviors that we feel reflect the peer groups we most closely identify with.

Our industry is well known for being risk averse, and for good reason. As protectors of public health, water suppliers need to ensure that nothing in their operations puts customers at risk due to water borne disease or other contaminants. Also, as most water utilities are municipally managed, water operators have little economic incentive to take risks with new technologies. Consequently, water suppliers have been slow to adopt new digital technologies that can provide many efficiency benefits – even when these technologies are not directly tied to the water quality operations that could impact public health.

Since risk taking is not encouraged or rewarded at most utilities, utility managers look to their peers for signals on what chances to take, what technologies to adopt, and how to approach financing these new investments. Since few people want to be the first to try something new, this explains the slow rate of initial adoption. This behavior perfectly reflects Moore’s technology adoption diagram, as only the ‘visionaries’ are likely to take the risk of trying a new, unproven solution.

This behavior also supports Godin’s views on social status. Utility managers are asking themselves something akin to “who do I know and trust that is doing something like this?” The associated peer group validates behavior, so it is important that most people compare their own activities with others that they identify as having similar status.

“Who do I know and trust that is doing something like this?”

This powerful combination of risk aversion and peer validation largely explains the slow rate of technology adoption in the water industry to date. While specific data is hard to come by, AMI adoption has been growing at a compound annual rate of roughly 6% for nearly the past decade. Over 30% of the approximately 100 million connections across the U.S. are automated in some form or another. Though many of these may be mobile reading systems, these technologies generally offer a relatively easy upgrade path to full AMI. A number of factors are now leading to an increased rate of AMI adoption. Recent studies expect a 12% compound AMI adoption growth rate over the next half decade. The business case for AMI has been validated over nearly a decade, and enough early adopters have embraced the technology that the industry has effectively ‘crossed the chasm’ into adoption by the early majority. In these cases, technology adoption generally accelerates from further cultural validation in the form of success stories and peer testimonials, as well as price declines due to associated economies of scale.

“The business case for AMI has been validated over nearly a decade. Enough early adopters have embraced the technology that the industry has effectively ‘crossed the chasm’ into adoption by the early majority.”

It’s worth acknowledging that financing AMI investments is another practical challenge to overcome in driving technology adoption. Yet even the financing of new technologies is evolving rapidly. New network technologies, public financing options, and emerging business models such as Network-as-a-Service are creating more economic flexibility for water utility managers and board members. What this means is more options than ever before to pay for these critical system upgrades. Our industry finds itself at the dawn of a new era of digital adoption, and the powerful cultural factors that influence human behavior are conspiring to speed up the rate of change. We see the benefits of these investments validated, but more importantly, we recognize that the perception of risks are shifting. Many of our peers have demonstrated the value of new technology investment which gives us the permission – perhaps even the mandate – to make similar investments to benefit our own communities.